The outdoor industry is chugging along nicely at the moment, with a good increase in ad spend in the latest ASA figures and plenty of action on the digital front from the big players. And two of those big players—oOh! Media and APN Outdoor—have released studies they hope will put a bit more wind in the sector’s sails.

Outdoor, much like digital, has long played up its role as a good addition to any campaign that’s already on TV. And oOh! Media has taken that even further by employing neuroscience to help advertisers figure out which part of the video content would work best on static or digital outdoor media.

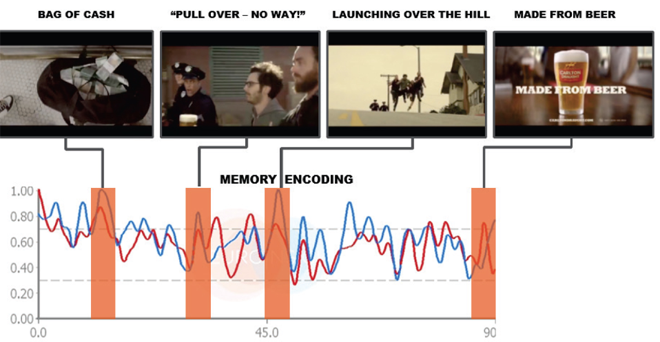

The ‘Iconic Trigger’ research by Neuro Insights found that by identifying the most powerful moment in TVC or video pre-roll and applying it to out-of-home environments, advertisers could increase a respondent’s long term memory measure by an average of 42 percent.

The findings are the result of testing 60 Australian and New Zealand commercials from the past two years from a range of different industries with consumers. Further neural testing was then conducted to identify the impact of using images in the out-of-home signage environment compared to other creative executions. Back in 2011, Adshel also embraced neuroscience, albeit for a slightly different purpose.

Carlton Draught’s Cannes award-winning TVC, ‘The Great Beer Chase’, was one of the ads that was analysed and the results can be seen in the images below. When asked for other local examples, a spokesman said companies submitted their commercials for the research and testing programme on the understanding it was confidential, and Carlton United was the only brand that agreed to supply the results publicly.

“Our Neuro Iconic Triggers tool removes much of the creative guesswork and gives clients the brain power to more accurately engage and influence growing audiences in out-of-home environments,” says chief executive Brendan Cook. “… The image effectively acts as the ‘replay button’ – re-triggering those memories which have been previously stored when originally watching the TVC or video pre roll.”

This study follows on from oOh! Media’s earlier research that demonstrated advertisers using TV and out-of-home together delivered 15 percent increases in ROI.

APN Outdoor has also been investing in research and, following on from last year’s Attention Economy study, which investigated the way people move, think, feel and respond to outdoor advertising, it has launched a series of advertiser category studies.

The new insights are designed to provide APN Outdoor’s clients with relevant and targeted information to use in the media planning process. Featured categories of the study include alcohol, automotive, entertainment, finance, FMCG, quick service restaurants, telecommunications and travel.

APN Outdoor has examined each advertiser category by considering it in relation to consumer purchase and behaviour habits as well as audience demographics, including gender, age, income and occupation.

The study also identifies how advertisers can reach and impact consumers of each category by identifying the related outdoor media opportunities. This aspect of the study looks at commuter habits and the key window where consumer engagement is at its highest. It also covers time spent with outdoor versus other mediums and the most effective outdoor formats to reach consumers of each specific category.

Top-level findings from the study include:

- 13% of New Zealanders drink at least one standard serving premixed spirit a week

- 23% of New Zealanders intend to buy/lease a new car in the next 12 months

- 55% of New Zealanders have been to the cinema at least once in the past few months

- 10% of New Zealanders will be looking for a home loan in the next 12 months, while 3% will be looking to refinance an existing home loan

- 59% of New Zealanders are the Main Grocery Buyer in the home and 33% share the responsibility

- 60% of New Zealanders visit a quick service restaurant at least a few times a month

- 29% of New Zealanders either don’t have a mobile pre/ post-paid plan or are looking to switch their plan

- 40% of New Zealanders intend to travel overseas in the next 12 months.

“Our new category study offers very detailed consumer and category information in relation to outdoor, as well as other mediums,” says Phil Clemas, general manager, APN Outdoor. “We are committed to driving the validity of the outdoor sector with solid data to prove its worth and will continue to invest heavily in this area as the year goes on.”

According to OMANZ, the outdoor sector has a goal of reaching five percent of total ad spend. The latest ASA report shows it is sitting at 3.5 percent market share, up $7 million on 2013.