The Interactive Advertising Bureau of New Zealand (IABNZ) has released the Q4 figures for 2014 and, somewhat unsurprisingly, the results again showed growth in the channel.

In Q4, advertising revenue in the digital channel reached $168 million, marking a 32 percent increase from the figure posted a year ago. The Q4 results also broke the quarterly record of $159 million that was set in the previous quarter.

In terms of individual category performance, the mobile sector recorded the biggest growth of 119 percent, although this came off a smaller base.

Search and directories increased by 54 percent over the same period while video revenue also reflected significant growth (31 percent).

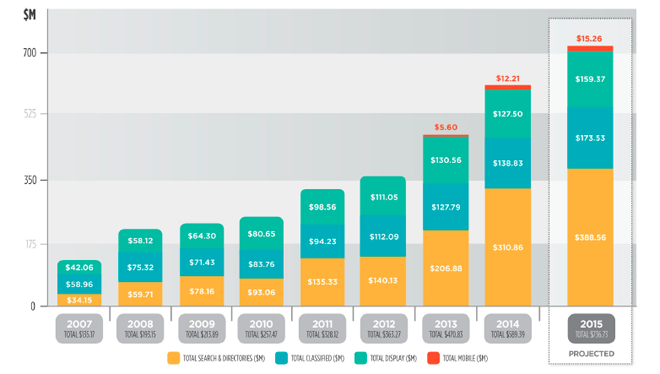

When viewed as a whole, digital ad spend grew 25 percent year on year in 2014 to post the highest total it has ever had in the New Zealand market.

“The $589m total spend superceded expectations and almost certainly puts the Interactive industry ahead of Newspapers in terms of advertising share for 2014,” says Adrian Pickstock, the chief executive of the IABNZ.

“Overall, the Q4 and full-year 2014 interactive revenue figures reflect the growing dominance of the sector. As a consequence, advertisers in New Zealand will be unable to achieve mass reach without factoring digital into their plans.”

This marked a significant rise from the $471 million posted over the course of 2013, and illustrates that advertisers are showing increased willingness to spend in the interactive category—and nowhere is this more evident than in the growth of mobile advertising, which shot up from $5.6 million in 2013 to $12.21 million in 2014.

“While the surge in Mobile advertising is impressive, it’s worth noting that the increase is off a small base with the sector holding 2.4 percent of the digital advertising spend,” says Pickstock. “This is significantly less than mobile share held in other comparable markets such as Australia where mobile holds 17.4 percent share.”

Pickstock believes that the Kiwi market is likely to follow the international trends.

“New Zealand has a strong existing base of smartphone and tablet users (2.2 million and 1 million respectively) and so we should expect to see the explosive growth in this channel continue as advertisers tap into this rich vein to their markets.”

Search and directories, a segment largely dominated by Google, also enjoyed growth, shifting from $207 million in 2013 to $311 million in 2014.

The same cannot be said for general display advertising, which declined from $131 million in 2013 to $128 million in 2014.

This shift is most likely driven by the growing sentiment among advertisers that display advertising, particularly in the form of banner ads, is ineffective. However, Pickstock points to the example of the United Kingdom, where the evolution in the display advertising model has seen brands willing to spend in the segment.

“Display advertising is the fastest growing category in the UK’s digital sector,” says Pickstock. “This is fuelled by increases in native and video spend, which together form 42 percent of the display spend.”

Although display advertising currently only holds a 21 percent share of the local advertising market, both brands and publishers are showing an increasing interest content marketing—and should this gain greater momentum, it’s possible that the Kiwi market might start to look more akin to that of the UK.